PropCruncher automates your market research

Find high-potential real estate opportunities faster

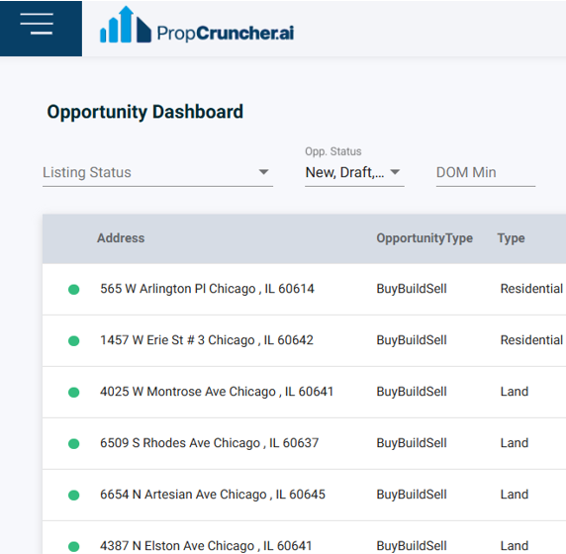

Every new land listing on the MLS is processed through PropCruncher’s AI engine to assess the property’s investment potential. Multiple investment models are tested to see if there can be a positive ROI. The analysis is delivered to you in a dashboard.

Every time you login, you might see a new investment opportunity waiting for you.

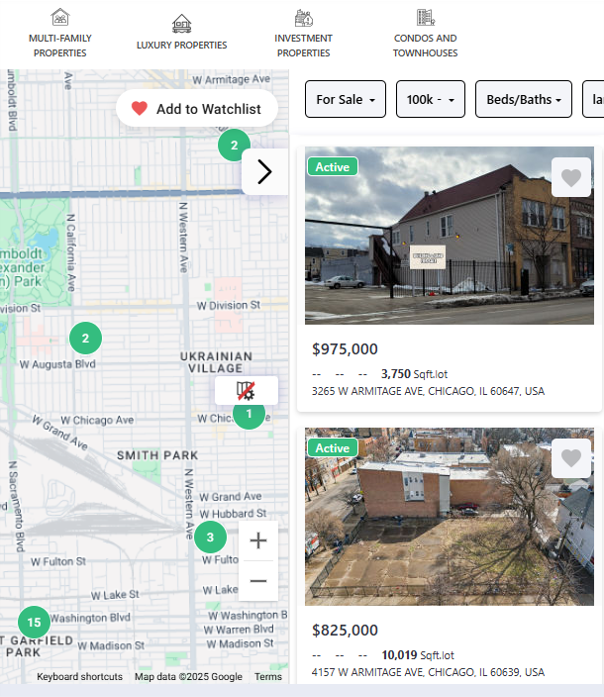

Analyze listed or off-market properties

Find listings and off-market properties in your market and add them to the PropCruncher Bot for automated analysis. You could also perform a detailed proforma analysis for your rental incorporating rent values and taxes from the assessor’s office.

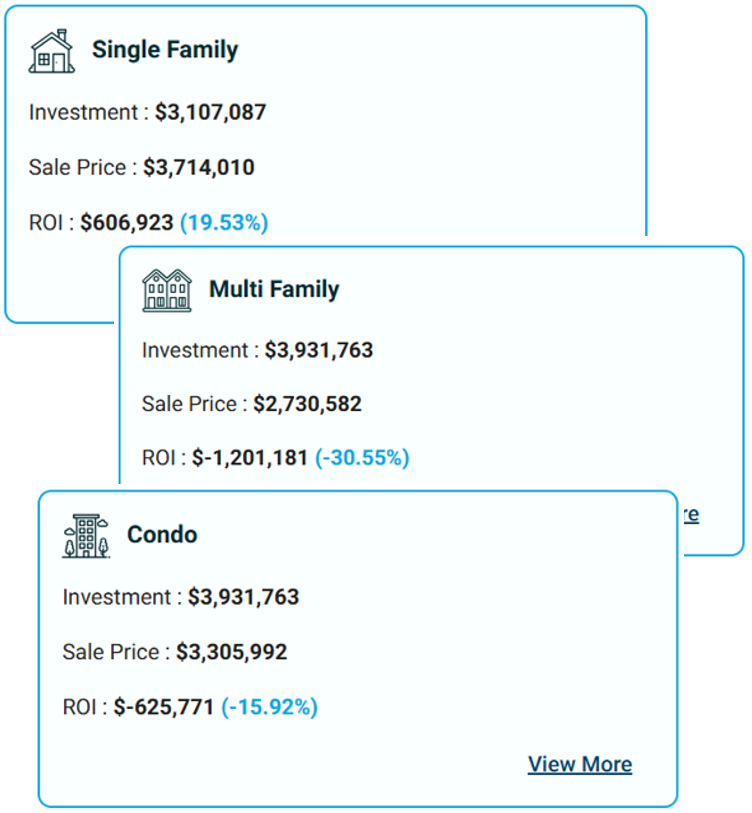

Run multiple investment models in every property using its Zoning

PropCruncher uses zoning information for the property to determine all the possible land uses and the investment return potential for each use. Multiple residential strategies are covered – Single Family, Multi-Family, and Condominium development.

Under the hood with PropCruncher

Data Preparation

PropCruncher is built on a core underlying platform that aggregates huge amounts of real estate data – county assessor records, MLS listings, school data, mortgage data, deed transfers, and more. This data platform includes a 25-year history of transactions and property images.

In addition, PropCruncher curates detailed zoning information which includes:

- Zoning District / Zoning Classification: A designated area within a municipality where specific land uses and development standards apply. Ex: R-1 for residential single family homes, C-2 for commercial, etc.

- Geographic Zoning Boundaries: Detailed boundaries for each zoning code.

- Floor-to-Area Ratios (FAR): The ratio of a building’s floor area to the size of the lot it is built on. FAR is used to limit the density of development in an area. An FAR of 1.3 on a 10,000 sq ft lot allows for 13,000 sq ft of total floor area to be constructed which could be spread across multiple stories.

- Maximum Structure Height: The maximum vertical height allowed for a building, typically measured from ground level to the top of the roof or parapet. Setting this limit preserves the neighbourhood character, limits shadowing, protects views, and controls building mass.

- Maximum Number of Units: The total number of residential units that may be constructed on a parcel, often based on density regulations or lot size. This controls population density and demands on local infrastructure.

Identify Investment Opportunity

When a new land listing is found on the MLS or when you add an off-market property or other listing for investment analysis in PropCruncher, the first step is to determine the property’s zoning classification. Very often the MLS listings do not include a zoning and so, PropCruncher derives the zoning for the property using zoning district boundaries and the property’s geolocation.

Build the Investment Models

Once zoning is determined we can now derive many different options for constructing a property at that location – single family home, multi-family, or condominium. Zoning also helps us determine the number of units, number of floors, and total building area for the new construction. And for return on investment, we consider both equity appreciation and income generation.

Equity appreciation models use both a Sales Comparison model and an Income based model to determine the post-construction value for the property. Sales Comparables make use of the school attendance boundaries to find the closest comps. This results in multiple models being generated for the property and determining the ROI and cash flow for each model.

Frequently asked questions

Typically, the investment opportunity will appear on your dashboard within 30 minutes of it being on the MLS. We pull data from the MLS every 15 minutes. When a new listing is found we immediately run all our AI-models on the property and the associated data to build the necessary insights and the investment models.

Yes. We do restrict the comps to the school attendance boundary of the property being analyzed. We do maintain school attendance boundaries and school district boundaries that you can use in your comparable searches as well. Simply search for the school by name and you can limit the comps to that school boundary.

Here, you can search for individual properties using the search bar or browse more broadly using the interactive map, filters, and property type shortcuts

Click on any property to view its listing details, photos, and more. Aso take action by clicking Analyze Property or Add as Opportunity

Perfect for developers and investors, this tool helps you determine what can be built on a site, and lets you save and download your analysis.

Welcome to OpScanner

Getting started is easy! First, head to the login page and enter your email. Click “Forgot Your Password?” to receive a link and set up your login. Once you’re in, you’ll land on the Explore page.

We are excited for our work and how it positively impacts clients.